Step-by-Step Walkthrough for

Safe Retirement Planning

Step 1: Qualification

The first step in your retirement planning journey is qualification. During this phase, we will assess your current financial situation, retirement goals, and risk tolerance. This involves:

Gathering Personal Information: We will collect details about your income, expenses, assets, and liabilities.

Understanding Your Goals: Discuss your retirement dreams, such as desired retirement age, lifestyle, and any specific financial needs.

Risk Assessment: Evaluate your comfort level with investment risks to tailor a plan that suits you best.

Step 2: Design

Once we have qualified your needs and goals, we will move on to the design phase. Here, we will create a customized retirement plan that aligns with your objectives. This includes:

Choosing the Right Products: Selecting financial products that offer safety and growth without market exposure.

Creating a Strategy: Developing a comprehensive strategy that outlines how your retirement funds will be allocated.

Visualizing Your Plan: Providing you with a clear visual representation of your retirement plan, including projected growth and income streams.

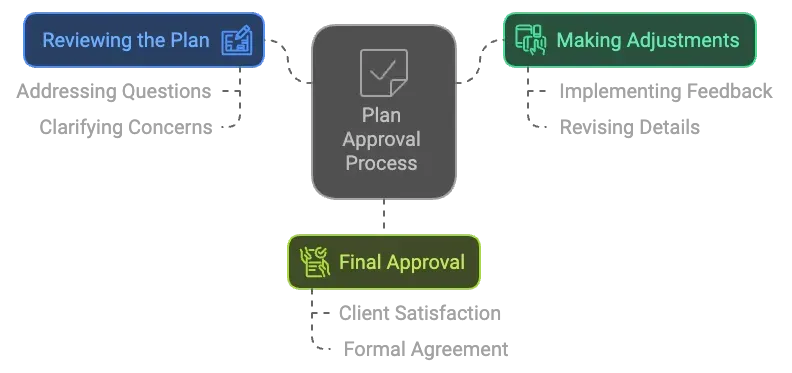

Step 3: Approvals

After the design phase, we will seek your approval on the proposed retirement plan. This step ensures that you are fully comfortable with the strategy before moving forward. Key actions include:

Reviewing the Plan: We will go through the details of the plan together, addressing any questions or concerns you may have.

Making Adjustments: If necessary, we can make adjustments to the plan based on your feedback.

Final Approval: Once you are satisfied, we will obtain your formal approval to proceed.

Step 4: Funding

With your plan approved, we will move to the funding phase. This step involves:

Setting Up Accounts: Establishing the necessary accounts to implement your retirement plan.

Transferring Funds: Coordinating the transfer of funds from existing accounts or investments into your new retirement plan.

Ensuring Compliance: Making sure all funding processes comply with regulatory requirements.

Step 5: Accumulation Phase

During the accumulation phase, your retirement funds will grow according to the strategy we designed. This phase includes:

Monitoring Growth: Regularly reviewing the performance of your investments to ensure they are on track.

Adjusting Contributions: Making any necessary adjustments to your contributions based on your financial situation and goals.

Staying Informed: Keeping you updated on any changes in the market or regulations that may affect your plan.

Step 6: Distribution Phase

Finally, we will enter the distribution phase, where you begin to access your retirement funds. This phase involves:

Creating a Distribution Strategy: Developing a plan for how and when you will withdraw funds from your retirement accounts.

Tax Considerations: Discussing the tax implications of your withdrawals to maximize your income.

Ongoing Support: Providing continuous support and adjustments to your distribution strategy as needed throughout your retirement.